A look at the profession and the actuarial science program at Roosevelt

“Why is the actuarial profession such a mystery?” That question was posed a short time ago by a woman who has been an actuary for more than 20 years.

“One would think,” she wrote in a magazine article published by the Society of Actuaries, “that reporting of actuary as the No. 1 job of 2015 by Forbes magazine might have given us a popularity boost.”

The truth is, she lamented to her colleagues, few people know what actuaries do and those who think they know often confuse actuaries with Certified Public Accountants (CPAs).

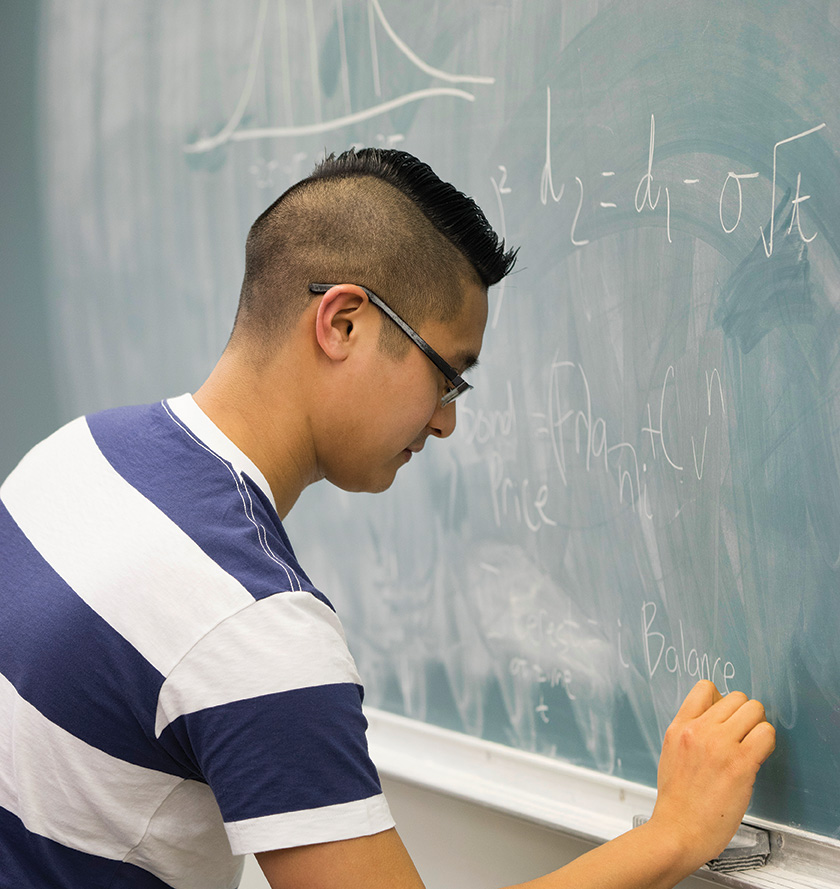

There’s nothing mysterious about actuarial science at Roosevelt University. In existence for more than 20 years, the actuarial science program is one of Roosevelt’s hidden gems and one of the top programs in Illinois. The rigorous program currently has about 40 undergraduate majors and 40 graduate students, and many of them will have a high probability of getting a great job when they graduate.

“The combination of healthy compensation, job satisfaction, manageable stress levels and robust growth land actuary in the No. 1 spot.”

Susan Adams, Forbes Magazine

Around the world, there are 169 colleges and universities with programs approved by the Schaumburg-based Society of Actuaries, including 11 in Illinois. Roosevelt is one of them and has plans to obtain the society’s coveted “Center of Actuarial Excellence” designation. Roosevelt’s program currently is ranked 24th in the nation by College Values Online based on tuition, financial aid, return on investment and exam preparation.

“We have a more strongly tailored program than other schools in the Chicago area,” said Melanie Pivarski, chair of the Department of Mathematics and Actuarial Science. “Some schools only offer a couple of actuarial science courses, but we have many, including courses students need for Validation by Educational Experience credits, which are a requirement for becoming an associate of the Society of Actuaries.”

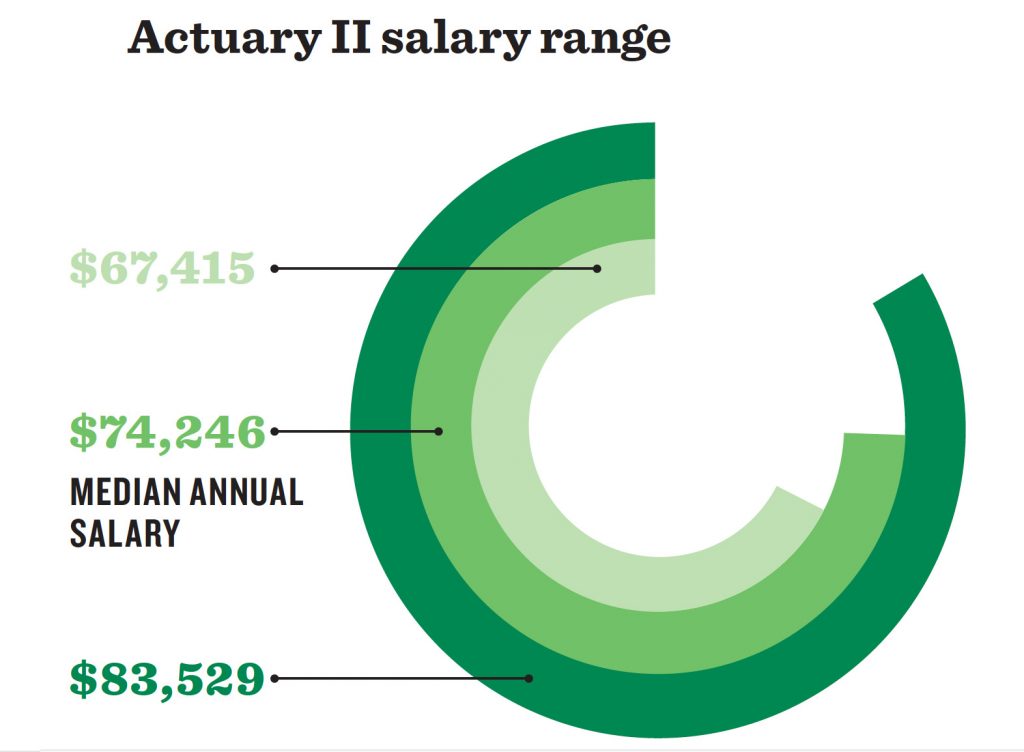

In her article on the best and worst jobs in 2015, Forbes reporter Susan Adams wrote: “The combination of healthy compensation, job satisfaction, manageable stress levels and robust growth land actuary in the No. 1 spot.” That assessment is bolstered by this impressive statistic: the median annual Actuary II salary is $74,246 with a range usually between $67,415 and $83,529.

Mathematics and Statistics

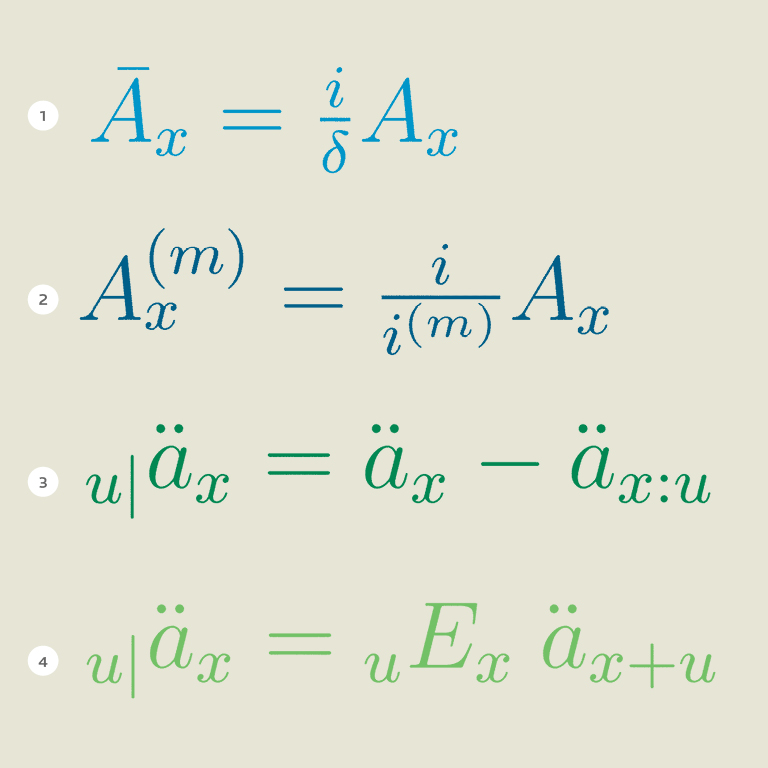

“Managing risk” is the quickest and easiest way to describe what actuaries do, said Wanwan Huang, a full-time actuarial science professor at Roosevelt. “Actuarial science takes mathematics and statistics and applies them to finance and insurance. The insurance industry hires the most actuaries, but they are also employed in many other industries including investment firms, banks, the federal government, including Social Security, accounting firms, and consulting organizations.”

These formulas describe the values of different insurance policies.

She explained that actuaries at insurance companies, for example, use large data sets of people, hospital statistics and accident reports to create mortality tables. “This helps the companies calculate how long people will live and how much money is needed to provide for them.”

But the profession is much more than “crunching numbers.” All actuarial students take advanced courses in economics, finance and statistics, in addition to calculus, probability and computer science.

The Credentials

left to right: Melanie Pivarski, chair of the Department of Mathematics and Actuarial Science and actuarial science professor Wanwan Huang.

Like doctors and lawyers, actuaries are credentialed by a series of professional exams that students begin taking in college and continue to take while working. To become an actuarial associate, individuals must pass five exams and to become a fellow they must complete 10 exams, which is roughly equivalent to earning a PhD.

Typically students with undergraduate degrees in actuarial science have already passed two exams before being hired as entry level actuaries. They will then often work four-and-a-half days at their firm and study the remaining half day for their next exam. For each exam they pass, they’re usually rewarded with a pay increase.

However, passing exams is not easy.Huang estimates that people need to study 300 hours for each three-hour exam and the pass rate is only 40 percent nationally.

“Anecdotally our students do better than that,” Pivarski said with a smile. “It’s because of our wonderful teachers! From 2010 through 2014, our students and alumni passed more than 140 actuarial exams, an average of 28 per year. We have study groups and provide a lot of support and resources. Wanwan has passed five exams, so she can tell students first-hand what they need to do to pass. Our students know the concepts; speed is the main thing they need to practice — how to complete the problems in the time frame they’re given.”

Dedicated Students & Friends

left to right: senior Nathan Gregory (actuarial science), senior Cuong Pham (actuarial science). graduate student Gigi Hoang (math), graduate student Anthony Urgena (math with actuarial science concentration)

“Since the actuarial major was small, I found myself in a lot of classes with the same people, many of whom I still keep in contact with today,” said Elizabeth Staszel (BS, ’13), a quantitative analyst with Milliman Financial Risk Management in Chicago. “A fond memory I have was that during junior year, two other students and I would come to the university on Saturdays, either in a classroom or the library, and study for Exam P. We had some memorable, productive study sessions. Professors in the Math and Actuarial Science Department were familiar with all of their students and were interested in what you were up to. Peers and faculty at Roosevelt created a great support system for me.”

Pivarski has a one-word answer when describing what type of individual makes a good actuarial student: “Dedicated.”

“You have to be really dedicated,” she said. “You have to be willing to put in extra time and extra effort. You can’t just go to classes and expect to turn out as an actuary. You have to actually spend extra time on your own studying. Plus, you should really enjoy math. If you don’t then you should do something different.”

“You have to be willing to put in extra time and extra effort. You can’t just go to classes and expect to turn out as an actuary.”

Melanie Pivarski, Roosevelt Faculty Member

Carina Balan, who has an undergraduate degree in actuarial science from Roosevelt and is currently in the graduate program, wanted to be an actuary since high school. “Math has always been the one subject that I looked forward to throughout my educational career,” she said. “During my junior year of high school at Hersey High School in Arlington Heights, I took the AP Statistics course and realized that ideally I would like to apply my knowledge of various mathematical, statistical and economical concepts to the real world. I began reading about actuarial careers, and I felt like this was the right choice for me.”

Vincent Dang, a 2014 a master’s degree recipient and now an actuary for Blue Cross Blue Shield, said he came to Roosevelt on the recommendation of a friend. “I was born and raised in Florida and never had the opportunity to live in a big city. The program was great when I was there and has even gotten better.”

left to right: Professor Huang working with senior Nathan Gregory.

The Changing World

After working on projects that involved risk for water companies, William Torres Amesty, an undergraduate physics major, decided to switch fields and become an actuary. Currently a graduate student in Roosevelt’s program, he already knows about the important roles actuaries perform in the industry. “Actuaries are business professionals and are expected to interact with clients and explain very technical concepts to those who might not have a good understanding of what you do, but they need to make business decisions based upon your opinion,” he said.

“The world changes so much that actuaries are constantly considering how ongoing external and societal forces affect a situation.”

Melanie Pivarski

That belief is echoed by both Pivarski and Huang. “The world changes so much that actuaries are constantly considering how ongoing external and societal forces affect a situation,” Pivarski said. “Once you determine that, you have to be a good communicator and be able to convince people that what you predict will happen.”

Roosevelt Looks Ahead

Obtaining the “Center of Actuarial Excellence” designation from the Society of Actuaries is the next step for Roosevelt’s Actuarial Science Program. There are currently no programs with this distinction in Chicago and only one in Illinois. To earn that label, the University plans to hire more full-time professors, publish faculty work in actuarial science journals, track student exam pass rates and continue connecting with its many alumni already working in the field.

Leave a Reply